Land Investment: underestimated opportunity

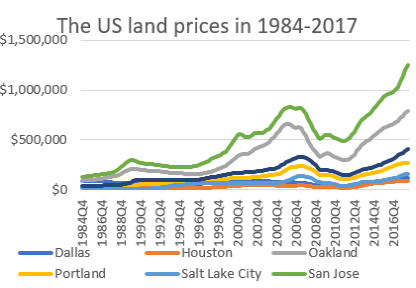

In 2020, Investors all over the world have been adjusting their strategies to what is now referred to as a ‘new normal’: volatility in equity markets, disruption in supply chains, limited production and shifted-consumption patterns. The reality shows that many assets that composed a solid portfolio before, aren’t able to provide confidence for investors in times of uncertainty. And among the asset classes there is the one, that our whole civilisation started from–land. Could it be the missing element that combines confidence and growth? In general, land brings its owner a range of benefits. First of all, historically it does not correlate with other major assets and economic cycles, showing less fluctuation. Land is often considered as a ‘boring’ asset, as nothing usually happens with it, but this feature is actually a valuable quality if the goal is to maintain long term sustainability. For instance, while companies can lose their market share and profits, bond issuers can default, owning real estate anticipates ageing, depreciation and maintenance expenses, in common circumstances land isn’t prone to such risks. Besides, the land has fewer competition compared to real estate market. As an example, we can see from the graph below that over the last three decades the land prices in American cities have been showing consistency with a solid pushback after the shock of the 2008 crisis.

Apart from that, owning land can also be indirectly beneficial in other business as well, as it can serve as collateral that can help to finance other projects and consequently expand the owner’s opportunities range. There is plenty of diversity within this asset class, as there are numerous ways to use it.

Land price varies depending on its soil quality and type, geographic location and infrastructural zoning, the logistic system around it, which creates multiple scenarios for investors.When speaking about land people often think of agriculture. Being one of the key vital industries for humanity at all times, nowadays it is still in the spotlight. Following the improving life quality, the global population has been growing exponentially over the last centuries. Current 7 billion people are likely to turn into 10 billion by 2050. And now the food production industry is not efficient already: while the poorest parts of the world are considerably underserved, in more developed regions up to 40% of produced products is thrown away because of useful time expiration or damage during delivery. Besides, the land value will inevitably rise according to the basic supply-demand equilibrium, as ‘they don’t produce it anymore’, so demand is constantly growing. So, the investors who don’t want to be involved in farming can rent their land out to farmers, whose business structure often involves renting land rather than owning it. Meanwhile, not any type of soil can be used for agricultural purposes and the one that is suitable sometimes is used extensively. That’s why estimating future returns of a given agricultural investment object is a matter of diligent planning. Another opportunity that opens up from owning such asset as land is potential income that lies beneath the surface: oil, coal and all metals are recovered from the properties, the owners of which permit businesses to develop it. Acquiring a piece of land that has undiscovered resources, however, requires effort and special expertise, but can potentially bring a positive income flow and increase the land price itself. Except for rural and uninhabited land, there is also one that suits for industrial, commercial and residential properties development. Unlike the objects that are built on it, the land itself, as mentioned, has fewer ongoing fees and risks, as well as can hardly be affected by external factors, enabling investor to hedge their portfolio. Aerial zoning changes is another important factor to consider with regards to land investment projects. Cities grow, and areas that used to be empty, have a chance to be involved in new development projects, leading to both price and application ways growth.

Land with planning permission has a much higher price than the similar one without it. However, it should be noted that such changes can take a considerable time to happen, and thus, investments of this type are a matter of long-term planning horizon. With all the opportunities that land can deliver, investors should also consider the low liquidity of this asset class: being a good option in a long run, it might be not easy to sell it shortly, so the investment strategy should be arranged accordingly. There are two major ways to invest in land: to purchase from the owner, and the second one is a purchase of Exchange Traded Notes(ETNs). ETNs track the corresponding indexes and, unlike ETFs, don’t own the assets that determine the index price, so buying them allows getting a speculative yield from land price changes, without actually owning it. Global population’s demand for food, housing and infrastructure is rising. And the pandemic seems to have accelerated this process, showing that land is a reliable and solid asset. After all, what investor profile can benefit from land acquisition? Except for those who primarily specialise on this sector and are actively involved in it, land can be a reliable and stable asset with multiple management scenarios, that can balance out the portfolio and bring consistent returns in the long term.